Let's go with a concrete example. In our goals map we have established that the first goal, the main result we want to achieve is

Maximize cash availability, today and tomorrow

And to achieve this result, we must necessarily significantly improve our process by "grassing" the intermediate objectives that we have identified:

- Maximize throughput

- Minimize stocks

- Minimize expired

- Take advantage of the monetary cycle

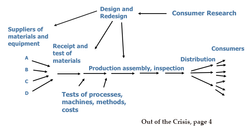

For those of you who are not familiar with the term "throughput", I remind you that it is a concept developed by Dr. Eli Goldratt is illustrated in the book The Haystack Syndrome (1990). Throughput Accounting — the accounting for throughput — was born as opposed to the traditional “industrial accounting” which, as explained by many studies, has progressively lost the ability to provide adequate information for the decision-making process, in particular due to:

- Of the allocation of overhead and labor costs to products

- Of the practice of considering warehouse stocks as "profits"

How does it work? Throughput Accounting is based on 3 measurement elements, amply sufficient to make daily business-related decisions. The three measures are: throughput (T), investments (I) and operating expenses (OE); in order we could define them contribution margin (T), investments (T) and operating costs (OE).

Throughput can be defined simply as the difference between sales revenues and totally variable costs related to what is sold. "I", on the other hand, measures all the money, the cash, as long as it remains invested in the company (raw materials, goods, accessories but also machines, plants, buildings); finally, the operating costs (OE) are all the costs that the company incurs, without distinction between variable and/or fixed, which are not related to the production and sale of the individual product, and which are necessary to make the company "work".

Having said this (necessary) premise, let's go back to us: at a time like this, when in addition to the problems caused by the market or internal inefficiencies, those due to the COVID-19 emergency overlap, is the cash register our "constraint"?

According to Ravi Gilani, one of the world's leading Theory of Constraints experts, we are in the presence of a "cash constraint" when the OTIF (On Time In Full) rate is less than 95% and suppliers do not deliver regularly because the company struggles to honor its commitments.

Poor cash *does not* constitute a cash constraint.

A note: OTIF (sometimes also DOTIF or DIFOT) is a performance indicator applicable to virtually all sectors, industry trade or services, and consists of two elements: On Time, which measures the ability to meet the delivery dates requested by its customers, and In Full, which measures the ability to deliver the entire quantity requested. Unfortunately, most companies either do not consider these measures, or "bend" them to their own intentions. It happened to me several times, after explaining this indicator, to ask: so, what is your punctuality rate? Invariably the answer is “excellent”! Or "excellent", only to then discover that when it is not possible to deliver by a certain date, the customer is called to inform him of the new delivery date that the company itself has determined!!

So, to summarize: our OTIF serves to evaluate the goodness of the process. If this indicator is less than 95% and is combined with difficulties in honoring supply debts, we can assume that cash represents a constraint. Conversely, the fact that the company may be in a condition of low liquidity, in itself, does not constitute a "cash constraint", although there is a good chance that - if you do not take countermeasures, it becomes one.

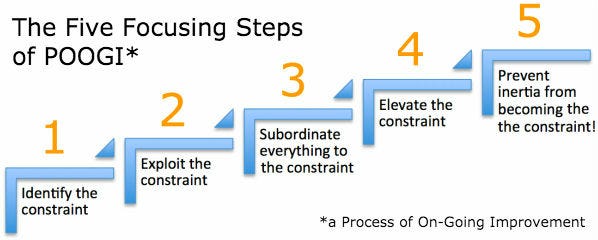

But let's go back to our process: the first step is to "identify" our constraint, that is, the factor that most limits the system. In the case in question, assuming that the cash register is not yet a problem, we could intuitively verify that our constraint is the market: we have sufficient production capacity, but not enough orders. In this hypothesis, the second step - deciding how to maximize the constraint - becomes obvious: to maximize the cash (our primary objective) you must arrive at an OTIF of 100%! We can't afford to "waste" anything, because the slightest delay would make us lose further opportunities.

The third step (subordinating each decision to the previous one) is probably the most difficult, both to understand and to put into practice. In the case in question we identified the market as a constraint and decided that to make the most of this constraint we must not miss a single opportunity, consequently we must also establish what to do with other resources, those that *do not* represent a constraint; abandoned to themselves, or not managed correctly, after a while problems could be created. Therefore, the most logical thing is to make sure that these are enslaved to the complete exploitation of the constraint resource. This, just to give a few examples, means that the OTIF must be measured, which *should not* be produced more than the constraint can sustain — we are in the presence of low liquidity, remember?, that orders should be processed according to a very precise priority scheme.

Once the process is stabilized (and the OTIF rate is presumably improved) you can think about the fourth step, namely how to further improve the performance of our constraint. In this case, for example, you could think of increasing the sales force, or approaching different markets such as, for example, abroad. Our hypothetical entrepreneur should, however, refrain from thinking about solving problems by jumping directly to this step because, think about it: in a situation like the one just described, a further weak link would be added to the chain of business processes, contributing in fact to the deterioration of performance - an effect that may not occur in the very short term, but certainly destined to occur in the long term.

Let's summarize. Our primary goal is to maximize cash availability and to do this we have identified 4 critical factors: (1) maximize throughput, (2) minimize stocks, (3) minimize expired and (4) take advantage of the monetary cycle. With reference to the critical factor “throughput” — and the process that generates it, we applied the 5 focusing steps (5 Focusing Steps sounds a bit better!):

- Identifying the limiting factor in the market

- Deciding that to exploit this constraint as much as possible it is necessary to maximize the OTIF rate (On Time, In Full)

- Subordinating every other resource to when decided

- Evaluating later (only after having "stabilized" the system) further ways to get even more from our constraint

If you think about it, this process will allow us, in addition to maximizing the thoughput (with the resources currently available), also to contribute to the achievement of the second critical factor (minimizing stocks) and, at least in theory, if customers are satisfied, even expired ones could be reduced. In any case, the amazing effect of a process like this is the ability to lay out all the excess capacity available to a company and this is a really strategically important element, because it will allow — subsequently — also to think about how to meet the critical factor (4), that is, to take advantage of the monetary cycle.

The last step is also, in some respects, the most important and suggests starting over, because continuous improvement is not an "event" but an infinite process.

As always, for any comments or further information, we are here to help! Feel free to contact us and schedule a preliminary meeting, no strings attached.